From GoKwik to Infosys, Digital Moves Stand Out in a Slower Week

While overall activity dipped, high-value deals in mobility, fintech, and digital infrastructure signal focused investor confidence.

What’s in This Edition

This week’s edition highlights cooling deal momentum, led by a pullback in M&A activity, even as private equity flows remained steady. While volumes dipped, sectors like industrials, fintech, and mobility drew investor focus with larger-ticket transactions. Noteworthy deals include Raphe MPhibr’s manufacturing push, GoKwik’s AI-led commerce play, and InCred’s continued platform expansion. Also featured are recent initiatives from Infosys, PhonePe, and the World Bank, signalling evolving priorities across industries.

Market Snapshot

Deal Momentum Slows Despite Steady Private Equity Interest

During the week of 23rd to 29th June, overall deal activity saw a notable slowdown, both in terms of volume and value. The total number of deals (including PE, M&A & ECM transactions) dropped from 33 to 24, while the cumulative deal value more than halved—from $510.6 million in the previous week to $221.5 million. This decline was primarily driven by a sharp reduction in M&A activity, which fell from 19 deals worth $259.6 million to just 4 deals totaling a modest $2.2 million. In contrast, private equity activity remained relatively stable in terms of volume, with 20 deals compared to 14 the week before, although the total investment value dipped from $251 million to $219.3 million. This shift in deal dynamics may reflect a move toward more cautious strategic decisions, even as private equity firms continue to deploy capital in targeted opportunities.

Deals in Spotlight

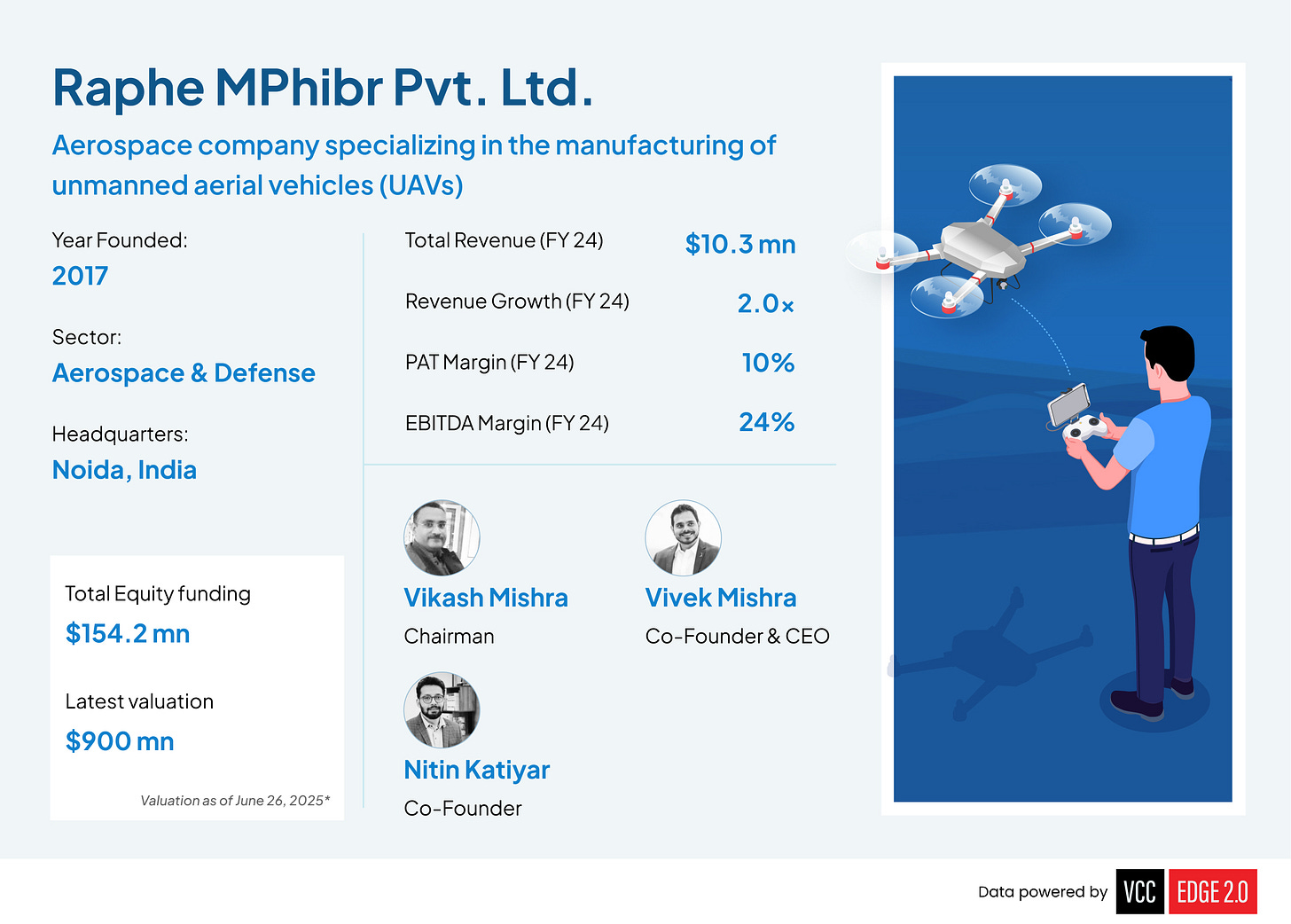

Raphe MPhibr Lands $100 Million to Scale Drone Innovation and Manufacturing in India

Backed by General Catalyst Group Management, LLC and others, the company plans to expand manufacturing, accelerate R&D, and strengthen strategic partnerships in India and internationally.

Kamath Brothers Invest $28.8 Million in InCred’s Holding Entity

The investment aligns with InCred’s strategy to build a diversified financial platform spanning lending, wealth and asset management, capital markets, and retail investing.

Pinnacle Mobility Locks in $23.1 Million of Funding from Enam Holdings

The capital will be used to enhance manufacturing capacity, establish three new plants, increase production of passenger and goods carrier vehicles, and diversify its product offerings.

GoKwik Raises $13 Million Led by Think Investments LLC and Others to Support Global Expansion

The capital will support GoKwik’s plans for international expansion and enhance its AI-powered e-commerce infrastructure.

Aaritya Technologies Pvt. Ltd. Bags $10.5 Million of Series A Funding from Accel India Management LLP and Others

The investment will help scale product development, expand the team, and grow the company’s presence across India.

If you're into quick updates like these, we post regular roundups on LinkedIn too. Check out our last edition here →

Company Deep Dive

Raphe MPhibr Strengthens Position in India’s Emerging Drone Tech Landscape

Raphe MPhibr Pvt. Ltd. has secured $100 million in funding from General Catalyst Group Management, LLC, Think Investments LLC, angel investor Amal Parikh, and other family offices. The capital will be used to scale manufacturing capacity, advance R&D efforts, and strengthen strategic partnerships both within India and internationally. This marks the largest private funding round raised by an Indian company in this sector to date, bringing Raphe MPhibr’s total funding to $145 million. Founded in 2016, the company has achieved over one million kilometres of flight, delivered the world’s first operational drone swarm, and developed India’s first indigenous, military-grade autopilot and lightweight internal combustion engine.

Unlock deeper insights on Omnia Information Pvt. Ltd. with VCCEdge — explore now

Sector Pulse: Industrials

During the week of 23rd to 29th June, the industrials sector recorded two deals totaling $107.7 million—marking a sharp rise from the previous week’s single deal worth $15 million, and nearly doubling the $56.7 million seen during 9th to 15th June. While deal volume remained modest and consistent, the spike in value suggests a pivot toward larger-ticket investments within the sector.

Quick Poll: What’s Your Take?

We’ll share the poll results in next week’s edition—stay tuned.

📊 Last Week’s Poll Results

We asked: IT has featured prominently in deal activity twice this month. What could be fueling sustained interest?

67% pointed to digital infra demand as the primary driver.

33% leaned toward broader tech optimism.

0% picked strong revenue models and broader tech optimism.

Updates You Might Have Missed

Infosys and Adobe Collaborate to Power AI-First Marketing Transformation

By combining strengths from Infosys Aster™ and Adobe, the collaboration aims to scale personalized customer engagement, enhance content-driven growth, and simplify marketing workflows through AI integration.

Johannes Zutt Takes Over as World Bank Vice President for South Asia

In his new role, Zutt will oversee development efforts and manage World Bank operations across six South Asian countries, guiding a $39 billion portfolio of financial and advisory programs.

PhonePe and HDFC Bank Unveil RuPay Credit Card with Built-In UPI Access

The co-branded card, powered by the RuPay network, will allow users to make UPI-enabled payments while earning rewards on routine transactions and purchases.