Zydus, Zaggle, and LoanTap Lead the Week as Investors Focus on Fewer, Bigger Bets

High-impact acquisitions and selective funding signal growing investor preference for long-term plays over volume-driven activity.

What’s in This Edition

Investors appeared more selective this week, favouring high-value M&A deals over broader private equity plays. Notable transactions from Zydus, Zaggle, and Aichi Steel point to a renewed focus on long-term capabilities and market positioning. Meanwhile, LoanTap’s fundraise signals growing confidence in digitised MSME finance. IT deal value rose despite a drop in volume, and major developments from Air India, Simplilearn, and TotalEnergies stand out among this week’s key highlights.

Market Snapshot

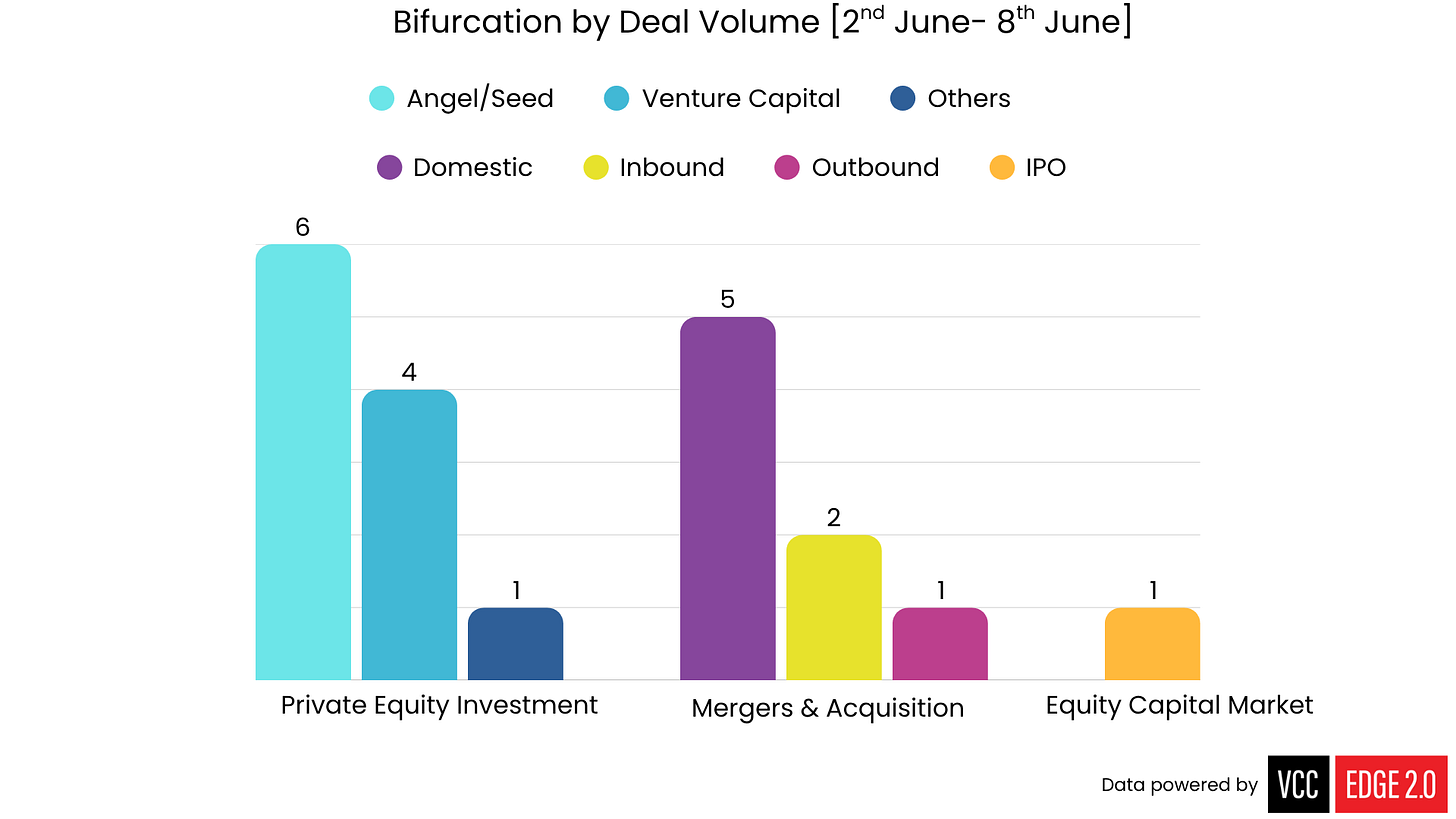

June Opens with M&A-Led Value Rise Despite Fewer Deals

During the week of 2nd to 8th June, overall deal activity saw a slight dip in volume but a modest rise in value compared to the previous week. The number of deals declined from 25 to 20 (including PE, M&A & ECM transactions), while total deal value increased from $278.8 million to $291.8 million. This uptick was largely driven by a sharp rise in M&A activity, which totaled $190.2 million across eight deals—more than four times the value recorded the week before. In contrast, private equity activity showed signs of cooling, with deal volume falling from 19 to 11 and value shrinking from $227.4 million to $93.2 million. The data could point to a potential pivot in investor focus toward strategic M&A plays, even as PE activity temporarily cooled, possibly reflecting caution in larger private capital deployments.

Deals in Spotlight

Zydus Acquires U.S. Biologics Facilities from Agenus in $125 Million Deal

The acquisition represents a strategic investment for Zydus in strengthening its U.S.-based biologics manufacturing, creating a long-term growth driver while positioning the company to benefit from efficient supply chains and favorable global market conditions.

Apollo Micro Systems Ltd. Raises $64.3 Million Funding from Minerva Ventures, B-LLC and others

As a part of the deal, the company will allot 2,70,42,894 equity shares and 2,424,307,812 convertible warrants at a price of INR 114 each.

Aichi Steel Secures Additional 13.57% Stake in Vardhman Special Steels for $45 Million

The acquisition will support the creation of a world-class green steel facility in India, focused on producing premium steel for the global automotive and engineering sectors, while also strengthening the long-standing partnership between the two companies.

Zaggle Eyes Growth with $14.4 Million Acquisition of Dice Enterprises

The acquisition will help Zaggle enhance its offerings for customers while gaining access to Dice’s large existing customer base. Additionally, the combined product suite is expected to support further expansion in the Indian market and open up opportunities to offer solutions globally.

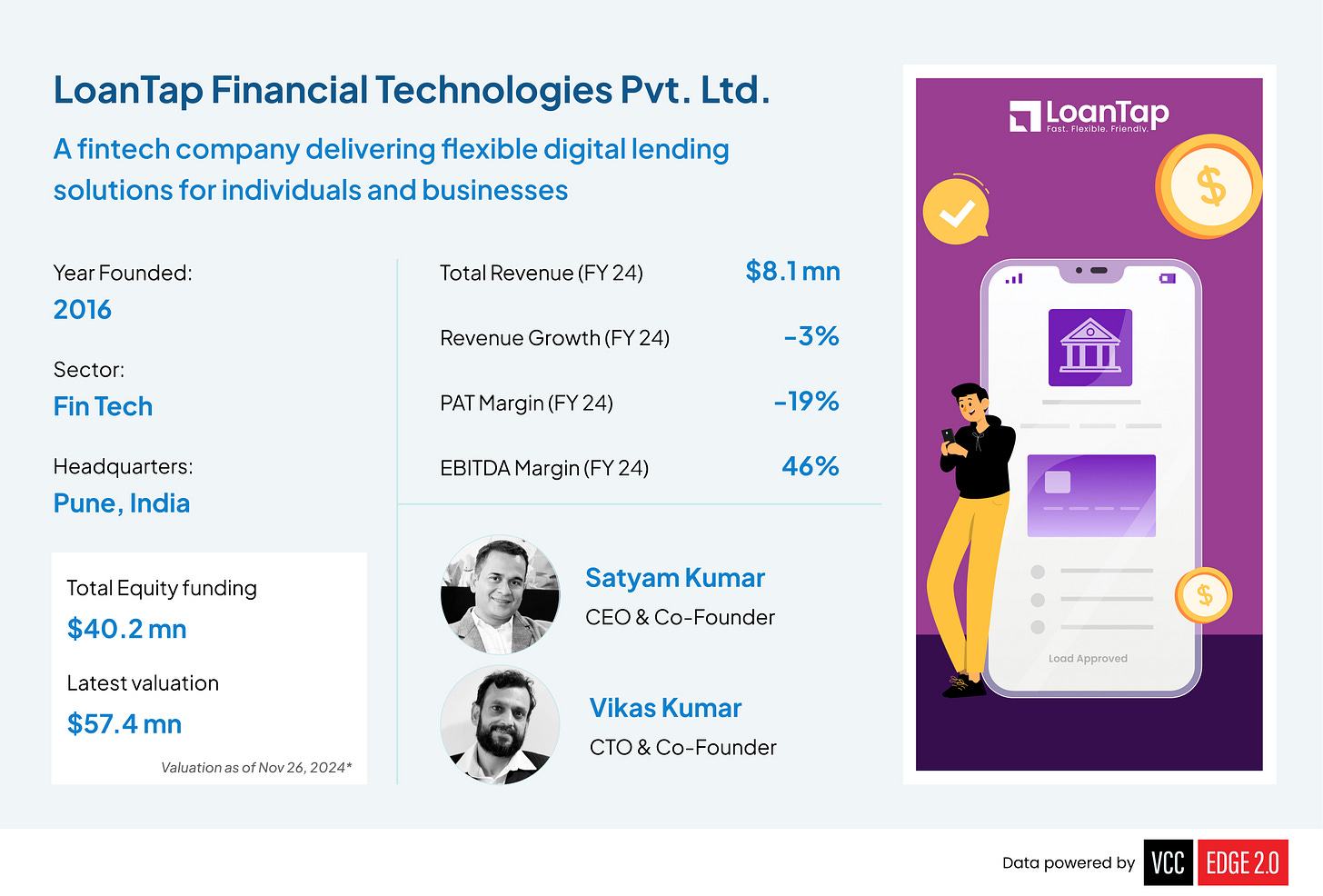

LoanTap Raises $6.3 Million in Pre-Series C Round Led by July Ventures LLP

The fresh capital will expand LoanTap’s supply chain financing solutions targeting India’s distributor-led small retailer ecosystem, particularly in essential categories such as grocery and pharmacy.

If you're into quick updates like these, we post regular roundups on LinkedIn too. Check out our last edition here →

Company Deep Dive

LoanTap Aligns Growth Strategy with India’s Evolving MSME Landscape

LoanTap, a digital lending platform, has secured $6.3 million in Pre-Series C funding from July Ventures LLP, along with participation from existing investors like 3one4 Capital, Avaana Capital, Kae Capital, and the Swapurna Family Office. With the newly raised capital, LoanTap aims to capitalize on the ongoing transformation in India’s MSME sector and expand its supply chain financing offerings, targeting the country’s distributor-led small retailer ecosystem—particularly in essential categories like grocery and pharmacy.

Unlock deeper insights on LoanTap Financial Technologies Pvt. Ltd. with VCCEdge — explore now

Sector Pulse: Information Technology

The information technology sector saw a dip in deal volume but a notable rise in value during the week of 2nd–8th June, with five transactions amounting to $78.6 million—up from $52.9 million across seven deals the previous week. This shift suggests that while the number of deals eased slightly, investors appeared more inclined toward higher-ticket opportunities, possibly indicating growing confidence in select, scale-ready tech ventures. One of the key transactions was a $6.3 million funding raised by LoanTap Financial Technologies Pvt. Ltd., which could point to increasing interest in focused plays within tech-led financial services.

Quick Poll: What’s Your Take?

We’ll share the poll results in next week’s edition—stay tuned.

📊 Last Week’s Poll Results

We asked: More startups are making bold moves into Tier 2 and 3 cities. What do you think is really fueling this shift?

50% pointed to rising demand as the primary driver.

50% leaned toward lower costs.

0% picked growth potential or government incentives.

Trending on VCCEdge

Exit strategies for LPs

Private market investments come with unique challenges, especially around exits. A thoughtful strategy helps LPs navigate the complexities of illiquidity while protecting their capital and ensuring long-term success.

Why family offices are turning to alternative investments

Moving beyond traditional investments, family offices are leveraging alternatives like private equity and venture capital to build diversified portfolios that offer higher returns and long-term stability.

Updates You Might Have Missed

Air India–Air Mauritius Partnership Grows with Extended Codeshare

Through the bilateral codeshare agreement, Air India and Air Mauritius will now share flight codes on 17 routes, offering improved access between the Indian Subcontinent and key African destinations.

Simplilearn Names Jitendra Kumar as CTO to Drive AI-first Shift

Previously instrumental in scaling the company through its web and mobile platforms, he will now take charge of its AI-first transformation, focused on integrating generative and predictive AI for personalised, global learning impact.

TotalEnergies Reaffirms Commitment to Adani Green’s Renewable Push

TotalEnergies has reiterated its support for Adani Green Energy Limited (AGEL), which currently operates with a 14 GW capacity and is pursuing further expansion. The partnership is set to play a pivotal role in advancing India’s clean energy transition and achieving its renewable energy goals.

Very insightful!!