GIVA, DCM Shriram, and Epimoney Mark a Week of Focused, High-Value Activity

PE-led gains and targeted acquisitions reflect an evolving focus on sector diversification and digital-first opportunities.

What’s in This Edition

Private equity momentum picked up this week, driving an increase in overall deal value even as M&A activity eased. Fundraises by GIVA, Snapmint, and Epimoney reflect continued investor appetite across consumer and fintech segments, while DCM Shriram’s acquisition marks a strategic expansion into advanced materials. The consumer discretionary sector showed signs of renewed traction, and updates from Paytm and Coinbase signal ongoing innovation in the digital ecosystem.

Market Snapshot

PE Momentum Lifts Weekly Deal Value

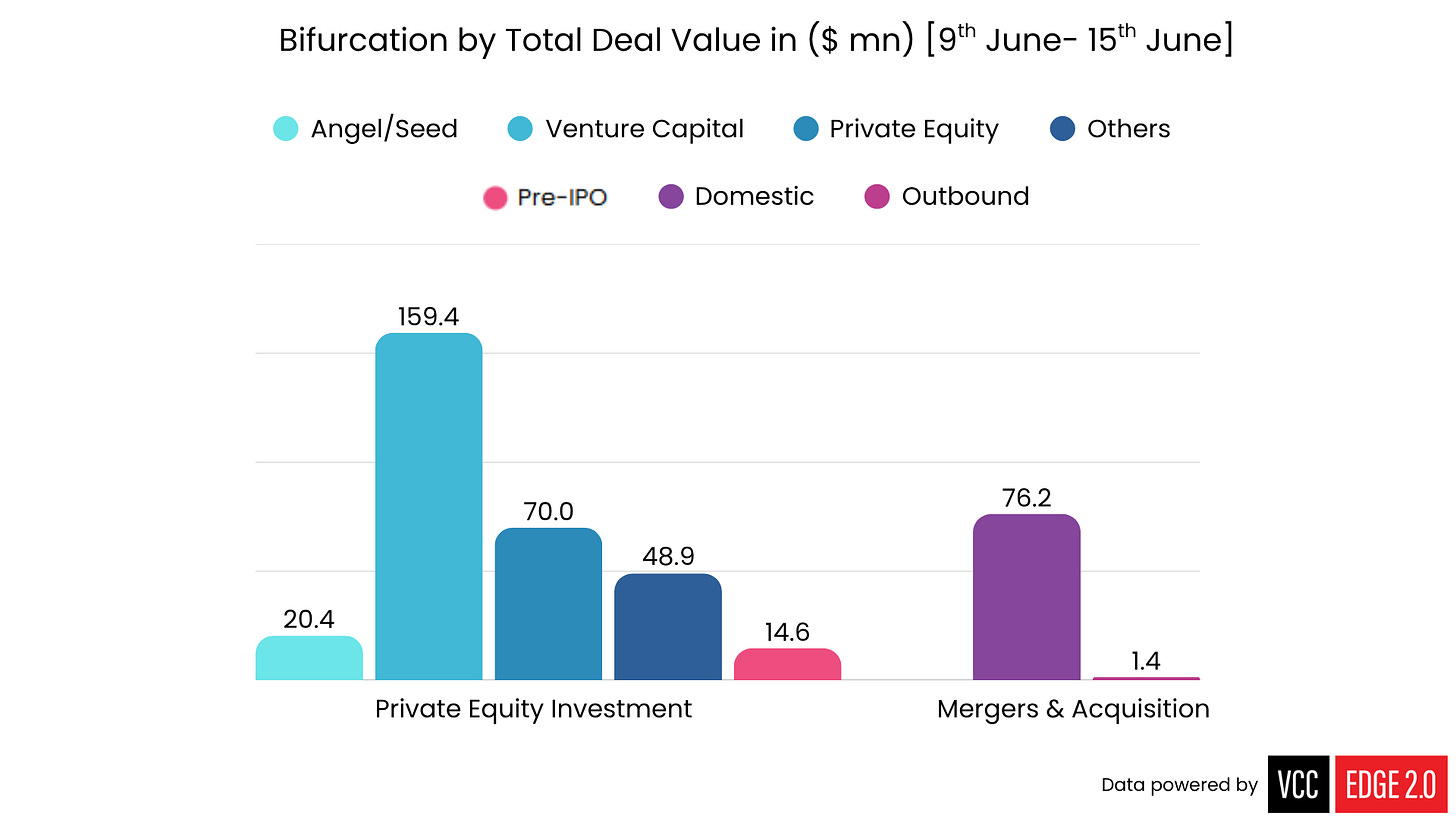

Deal activity during the week of 9th to 15th June showed a modest increase in both volume and value compared to the prior week. The number of deals rose slightly from 20 to 22 (including PE, M&A & ECM transactions), while total deal value grew from $291.8 million to $390.9 million. This growth was largely supported by a rebound in private equity activity, which recorded 17 deals totaling $313.3 million—more than triple the PE value seen the previous week. Meanwhile, M&A activity eased somewhat, with deal count decreasing from 8 to 5 and value declining from $190.2 million to $77.6 million. The data may point to rising interest in PE deals, even as M&A activity slowed during the week.

Deals in Spotlight

GIVA Secures $52.5 Million in Series C Round of Funding from Creaegis Investment Fund II and Others

As part of the deal, the company will issue 1,73,430 Series C CCPS at a price of INR 25,947 each. The capital will be utilized to support operational requirements, including talent acquisition, marketing initiatives, general corporate needs, and related expenses.

Devyani International Ltd. Raises $48.9 Million from Alpha Wave Ventures and Others

The company allotted 2,37,18,413 equity shares at a price of INR 176.78 each, as part of the transaction, amounting to $48.9 million in total consideration.

DCM Shriram to Acquire Hindusthan Specialty Chemicals for $ 43.8 Million, Marking Entry into Advanced Materials Segment

The acquisition will enable DCM Shriram’s chemicals division to expand into the Epoxy and Advanced Materials space, serving as a downstream integration of its Epichlorohydrin (ECH) operations.

Epimoney Pvt. Ltd. Bags $43.8 Million in Series C Round of Funding from Accion Digital Transformation Fund, LP and Others

The company intends to deploy the new funds to scale operations, broaden its product portfolio, and upgrade its technology capabilities.

Snapmint Credit Advisory Pvt. Ltd. Locks in $40 Million from 100Unicorns and Others

The funding will support Snapmint’s expansion into new product lines, grow its merchant network, and strengthen its technology stack.

If you're into quick updates like these, we post regular roundups on LinkedIn too. Check out our last edition here →

Company Deep Dive

GIVA Scales Operations Amid Rising Demand for Affordable Jewellery

Jewellery brand GIVA has raised $52.5 million in a Series C funding round led by Creaegis Investment Fund II, with participation from Premji Invest, Epiq Capital, and other investors. Established in 2019, GIVA began as an affordable jewellery brand and has since diversified into gold jewellery and lab-grown diamonds. The company now operates 150 physical stores across India, alongside its online platforms. With the newly raised funding, GIVA plans to support its operational needs, spanning talent acquisition, marketing, corporate functions, and other key expenses.

Unlock deeper insights on GIVA with VCCEdge — explore now

Sector Pulse: Consumer Discretionary

The consumer discretionary sector appeared to regain momentum during the week of 9th to 15th June, recording the highest deal volume across sectors, with five deals totalling $145.2 million. This marks a notable jump from the previous week’s muted activity, when the sector logged only three deals worth $6.1 million. Interestingly, this uptick follows a strong showing in late May as well, which may indicate a trend of periodic spikes in investor interest. While it is too early to call this a sustained recovery, the recent activity suggests that investors may be taking a closer look at consumer-driven opportunities.

Quick Poll: What’s Your Take?

We’ll share the poll results in next week’s edition—stay tuned.

📊 Last Week’s Poll Results

We asked: IT deal volume dipped but value rose last week. What could this suggest about the investment mood?

50% pointed to focus on larger opportunities as the primary driver.

50% leaned toward shift toward mature startups.

0% picked selective investor confidence or normal market fluctuation.

Trending on VCCEdge

Turning Market Signals Into Business Strategy: Key Lessons from PE Investors

Private market investments come with unique challenges, especially around exits. A thoughtful strategy helps LPs navigate the complexities of illiquidity while protecting their capital and ensuring long-term success.

How Family Offices Are Driving Startup Investment in India

India’s startup surge is increasingly being powered by modern family offices. Combining legacy wisdom with future-ready strategies, they’re unlocking fresh capital, fostering innovation, and driving meaningful exits in the private market.

Updates You Might Have Missed

Former Nykaa Business Head Shailendra Singh Named Co-Founder & COO at D’Moksha

He previously held senior leadership positions at Hindustan Unilever Limited, where he led sales, before serving as Business Head at Nykaa. His appointment marks a significant milestone in D’Moksha’s plans for a major rollout in India.

Paytm Rolls Out Personalized UPI IDs to Boost Privacy and Limit Mobile Number Exposure

The feature enables users to create personalized UPI IDs, such as name@ptyes or name@ptaxis, allowing transactions without disclosing their mobile numbers. The service is now live through Yes Bank and Axis Bank handles, with plans to expand to other banking partners soon.

Coinbase Unveils American Express-Backed Crypto Credit Card with Bitcoin Cashback

The new card will provide 2% to 4% Bitcoin rewards on everyday spending, along with American Express benefits. The launch aligns with Coinbase’s broader strategy to grow its subscription services.